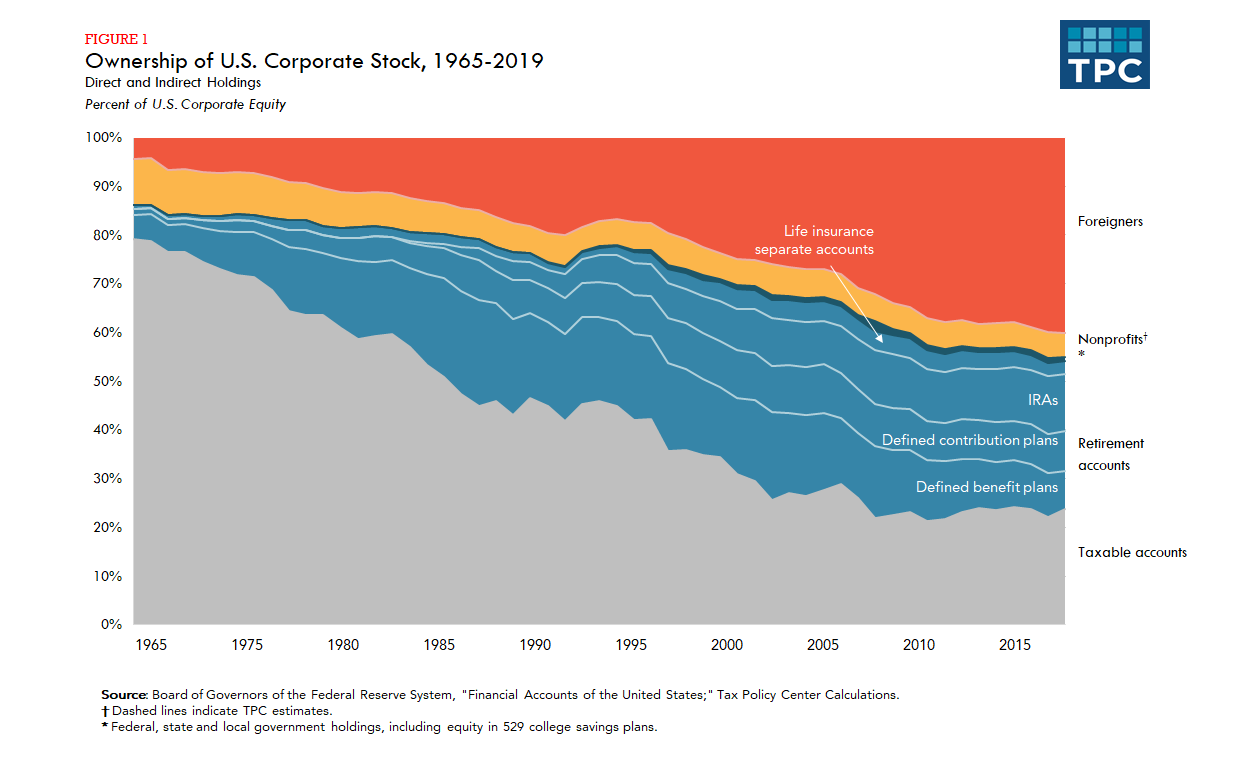

Our new analysis shows that foreign investors owned about 40 percent of US corporate equity in 2019, up substantially over the last few decades. Retirement accounts of US households owned about 30 percent in 2019, and the taxable accounts of US investors owned about 25 percent, which is most of the rest.

Our new working paper reaffirms the shift in US equity ownership to tax-exempt accounts, from taxable accounts, which Lydia Austin and I first described in a 2016 article, and particularly the shift to foreign investors, which I highlighted in a 2017 article.

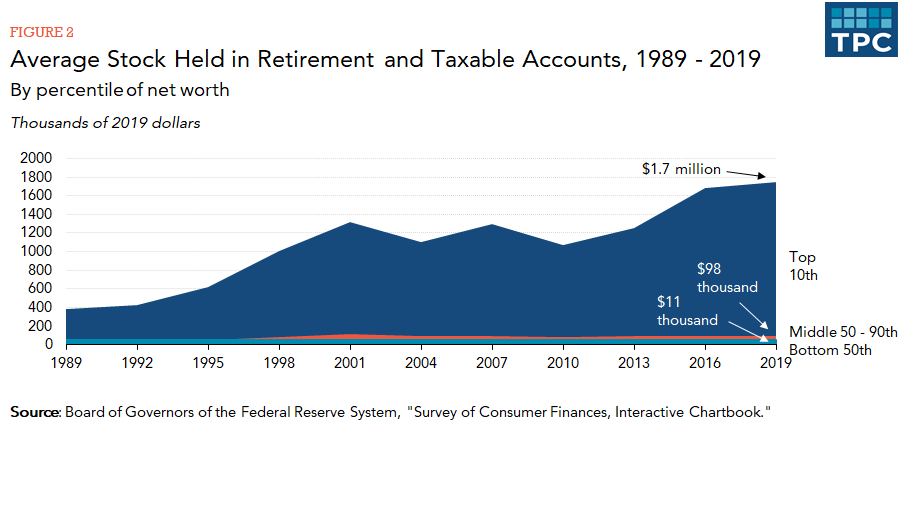

Our new analysis also examines more closely the ownership of stock by US households (combining equities held in both retirement and taxable accounts, in blue and grey above) with data published last month based on the Federal Reserve’s 2019 Survey of Consumer Finances.

The Fed found that the average household in the richest tenth of US households, by net worth, owned vastly more stock than those in the bottom half. That is, those households that owned stock in the wealthiest 10 percent of households, owned an average $1.7 million of stock while those in the bottom 50 percent owned an average of only about $11,000. Virtually all (94 percent) of the wealthiest 10 percent of households owned stocks, while only about a third (31 percent) of the bottom 50 percent owned stock, either directly or indirectly (e.g., through mutual funds).

We plan to present this new analysis on October 27 for the Tax Policy and Public Finance Colloquium and Seminar at NYU. (Those interested in attending can e-mail Professor Shaviro to request the Zoom link.) We welcome suggestions and comments.